Land Banking in Nigeria: Smart Investment or Money Trap for Diaspora?

Should you buy raw land in Nigeria and hold for 5-10 years? Here's the truth about land banking returns, risks, and whether it's right for diaspora investors.

Your friend just posted on the UK Nigerian WhatsApp group:

"Bought land in Epe for ₦3 million in 2018. Just sold for ₦15 million. 400% return in 7 years. Land banking works!"

You're intrigued. You don't want to deal with tenants, construction, or property management drama. You just want to buy land, hold it, and sell later for massive profit.

Is it really that simple? Buy cheap land in an undeveloped area, wait 5-10 years, and cash out when the area develops?

The short answer: Sometimes yes, sometimes catastrophically no.

Land banking can multiply your money 3-10× in a decade. Or your land can sit worthless for 20 years while you bleed money on security and taxes.

The difference? Understanding how land banking actually works—and what separates smart land bankers from people who just bought expensive dirt.

Let me show you both sides.

What Is Land Banking?

Land banking is buying raw, undeveloped land in areas expected to grow, holding it for 5-15 years, and selling at a significant profit when development reaches the area.

You're not building. You're not renting. You're just buying and waiting.

Classic Example:

- 2010: Buy 500 sqm in Sangotedo (Lekki outskirts) for ₦2 million

- 2015: Lekki development expands, your land is now worth ₦8 million

- 2020: Infrastructure improves, roads tarred, your land is worth ₦20 million

- 2025: You sell for ₦25 million

Your investment: ₦2 million (plus holding costs) Your return: ₦25 million Net profit: ₦23 million (1,050% return over 15 years)**

This is what drives the land banking hype.

The Success Stories (Yes, They're Real)

Let's look at actual appreciation patterns in Lagos over the past 15 years:

Case Study 1: Lekki Phase 1

- 2005: ₦5-8 million per plot

- 2015: ₦40-60 million per plot

- 2025: ₦80-120 million per plot

Appreciation: 1,400-1,900% in 20 years

Early buyers made fortunes.

Case Study 2: Ajah/Sangotedo

- 2010: ₦2-3 million per plot

- 2015: ₦6-10 million per plot

- 2025: ₦18-30 million per plot

Appreciation: 900-1,400% in 15 years

Again, massive returns.

Case Study 3: Ibeju-Lekki

- 2015: ₦3-5 million per plot

- 2020: ₦8-12 million per plot

- 2025: ₦12-20 million per plot

Appreciation: 300-500% in 10 years

Still very strong.

These stories are real. People who understood growth patterns and timed their purchases correctly multiplied their wealth through land banking.

But now let me show you the other side.

The Failures (What They Don't Tell You)

Failure Story 1: The Road That Never Came

Investor: Chidi, US-based software engineer Purchase: 2012, bought land in "upcoming area" outside Lagos for ₦4 million Promise: "Government is building a major road here in 2 years. Prices will skyrocket." Reality: 13 years later, no road. Land still undeveloped. Worth maybe ₦6 million. Opportunity cost: If he'd bought Ajah instead, his ₦4M would be ₦25M+.

Failure Story 2: The Disputed Land

Investor: Adaeze, UK-based nurse Purchase: 2015, bought land in Epe for ₦2.5 million Problem: Land has family ownership disputes. Can't sell because title is unclear. Result: Been paying security guards for 10 years (₦500K+). Can't build or sell. Likely total loss.

Failure Story 3: The Government Acquisition

Investor: Tunde, Canada-based accountant Purchase: 2017, bought land in path of proposed Lekki airport for ₦5 million Problem: Government acquired the area without proper compensation Result: Lost ₦5 million + legal fees trying to fight it

Land banking isn't guaranteed. For every success, there's a failure you don't hear about.

When Land Banking Works: The 7 Critical Factors

Factor 1: Proximity to Developing Infrastructure

Land appreciates because infrastructure comes.

What drives appreciation:

- New roads (Lekki-Epe Expressway expansion drove Sangotedo/Ajah growth)

- Airports (Lekki Airport proposal boosted Ibeju-Lekki/Epe)

- Seaports (Lekki Deep Seaport increased commercial interest)

- Industrial zones (Dangote Refinery in Ibeju-Lekki)

- Government estates or new city projects

Your job: Identify where infrastructure is coming BEFORE everyone else realizes it.

Factor 2: Clear, Undisputed Title

You can't sell land with questionable ownership.

Non-negotiables for land banking:

- Valid Certificate of Occupancy

- Clear chain of title going back 30+ years

- No family disputes

- No community claims

- Governor's Consent obtained (or obtainable)

One document problem can trap your money for decades.

Factor 3: Timing (Buy Early, Not Late)

Too early: Buy when there's no development in sight. You wait 20 years and still nothing. You die before the area develops.

Too late: Buy after everyone realizes the area is hot. You pay inflated prices and appreciate only 50% instead of 500%.

Just right: Buy 2-5 years before major infrastructure completes. Early enough to get good prices, late enough that development is actually happening.

Factor 4: Location's Natural Growth Path

Some areas are naturally in the growth path. Others aren't.

Lagos grows eastward and northward due to geography (lagoons and ocean block westward expansion).

- Eastward: Lekki → Ajah → Sangotedo → Ibeju-Lekki → Epe

- Northward: Ikeja → Ojodu → Berger → Magboro → Mowe-Ibafo

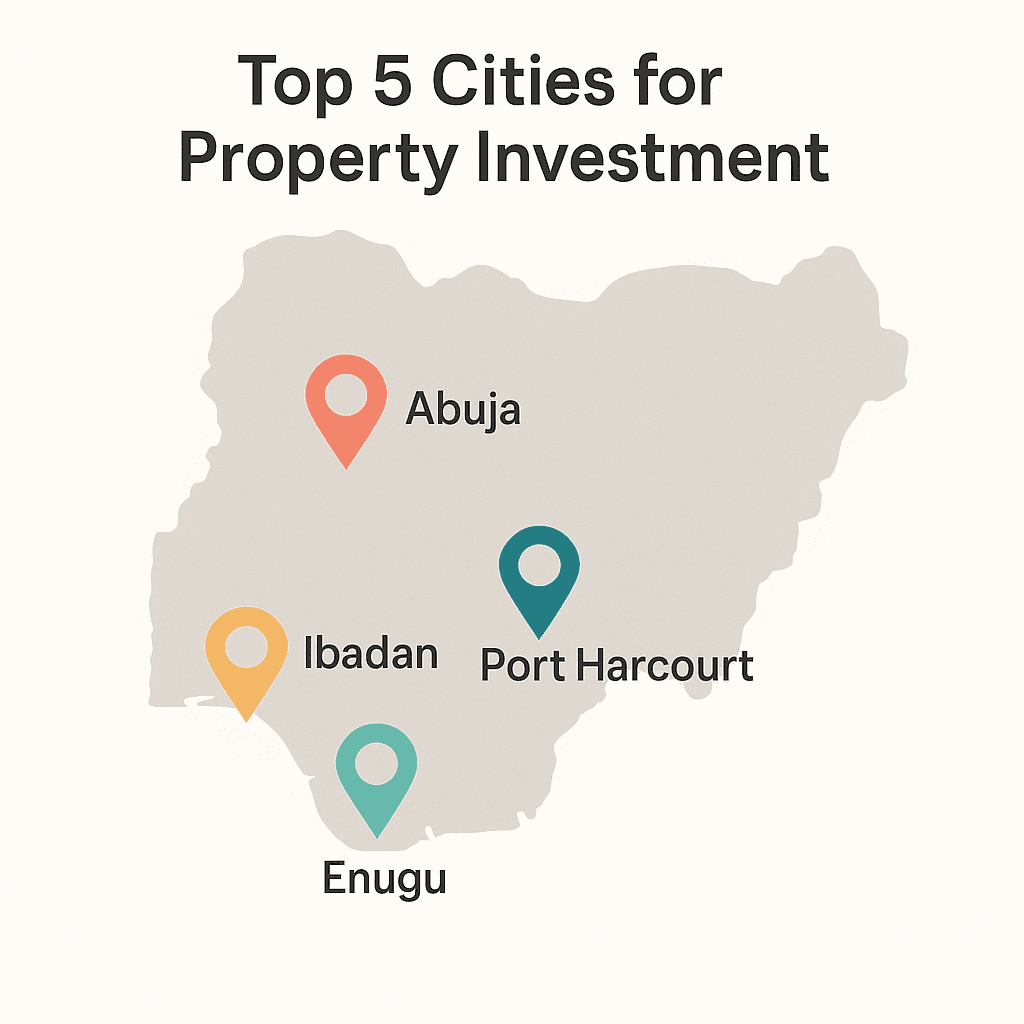

Abuja grows outward from the center toward satellite towns.

Your land should be in the logical path of expansion.

If you buy land in a random village 100 km from Lagos with no connection to growth corridors, it'll stay worthless.

Factor 5: Economic Fundamentals

Land appreciates in growing economies with rising middle class.

Nigeria's fundamentals:

- Growing population (200+ million, projected 400M by 2050)

- Urbanization (more people moving to cities)

- Diaspora investment (billions annually)

- Rising middle class (more people who can afford land)

But also consider risks:

- Currency devaluation (naira weakness)

- Economic recession (kills demand)

- Political instability

- Brain drain (skilled Nigerians leaving)

Land banking works best during economic expansion. During recession, prices can stagnate for 5-10 years.

Factor 6: Low Carrying Costs

Land banking isn't free. You pay:

- Annual property tax

- Security guards to prevent encroachment

- Periodic fencing repairs

- Land surveying (to verify boundaries)

Example annual costs:

- Security: ₦500,000-₦800,000/year

- Taxes: ₦50,000-₦150,000/year

- Maintenance: ₦100,000-₦200,000/year

Total: ₦650,000-₦1,150,000 annually ($500-$900 USD)

Over 10 years, that's ₦6.5-11.5 million ($5,000-$9,000 USD) in holding costs.

If your land appreciated from ₦5M to ₦15M, your net profit is only ₦3.5-8.5M (30-70% less than gross appreciation).

Choose land in safer areas where you can minimize security costs.

Factor 7: Exit Strategy

Know how you'll sell before you buy.

- Is there an active land market in this area?

- Are people actually buying and building here?

- Can you get your money out in 30-90 days if needed?

Liquidity matters. Land in obscure locations may have great appreciation potential but zero buyers when you need to sell.

Land Banking vs Other Investments (The Comparison)

Let's be honest about opportunity cost.

Land Banking vs S&P 500 (US Stock Market)

Scenario: You invest $10,000 in 2015

Option A: Nigerian Land (Ajah in 2015)

- Buy land for ₦5 million ($10,000 at 2015 rates)

- 2025 value: ₦25 million ($16,000 at 2025 rates)

- Holding costs: -$5,000

- Net profit: $1,000 (10% return over 10 years)

Option B: S&P 500 Index Fund

- Invest $10,000 in 2015

- 2025 value: ~$26,000 (10% average annual return)

- Net profit: $16,000 (160% return over 10 years)

S&P 500 wins in this scenario because naira devaluation eroded your dollar gains.

BUT: If you'd bought better-located land (Ibeju-Lekki near Dangote Refinery), your ₦5M might be ₦35-40M today, giving you $20,000+ even after naira devaluation.

The lesson: Land banking beats US stocks ONLY if you pick high-growth locations and Nigerian economy stays relatively stable.

Land Banking vs Rental Property

Scenario: You have $20,000 to invest

Option A: Land Banking

- Buy ₦25M land in developing area

- Hold 10 years

- Sell for ₦65M (160% appreciation)

- Holding costs: -₦8M

- Net: ₦57M ($36,000)

Option B: Rental Apartment

- Buy ₦25M apartment in established area

- Rent for ₦2M/year × 10 years = ₦20M in rent

- Property appreciates to ₦40M

- Maintenance costs: -₦5M

- Net: ₦55M in value + ₦15M in net rent = ₦70M ($44,000)

Rental property wins due to cash flow during holding period.

But: Land requires far less management (no tenants, no maintenance). If you value time and simplicity, land banking may still be better despite lower returns.

The Smart Land Banking Strategy for Diaspora

If you decide land banking fits your goals, here's how to do it right:

Step 1: Choose Your Timeline

Land banking is minimum 5-10 years. Preferably 10-15 years.

If you need money in 2-3 years, don't land bank. Too short for meaningful appreciation in most cases.

Step 2: Diversify Locations

Don't buy one giant plot in one area.

Better: Buy smaller plots in 2-3 different growth corridors.

Example budget: $30,000

- $10,000 in Ibeju-Lekki (high-growth bet)

- $10,000 in Epe (very high risk, very high reward)

- $10,000 in Abuja outskirts (geographic diversification)

If one area doesn't develop, the others might.

Step 3: Buy Near Announced Infrastructure

Research:

- Proposed roads

- New airports

- Industrial free zones

- Government new city projects

Buy land 2-5 km from these projects BEFORE they complete.

Where to research:

- Lagos State Ministry of Works website

- FCT Abuja master plan

- Nigerian news (ThisDay, Punch, Vanguard real estate sections)

- Infrastructure project announcements

Step 4: Verify, Verify, Verify

Spend 20% of your purchase budget on due diligence:

- Lawyer's title search: $500-$1,000

- Surveyor's physical verification: $300-$500

- Community investigation (talk to neighbors, baale): $200

- Document verification: $200-$400

On a $20,000 land purchase, spend $1,500-$2,400 on verification.

This prevents buying disputed land or non-existent land.

Step 5: Secure Immediately

The day you complete purchase:

- Fence the perimeter

- Install signage with lawyer's contact

- Hire a security guard or caretaker

- Take drone photos/videos (proof of condition)

Don't wait. Encroachment happens fast.

Step 6: Budget for Holding Costs

Set aside 15-20% of purchase price for 10-year holding costs.

Example:

- Buy land for $15,000

- Set aside $2,500 for 10 years of security, taxes, maintenance

Don't underfund this. Running out of money to maintain the land 5 years in can force you to sell at a loss.

Step 7: Set Review Milestones

Don't buy and forget for 10 years. Review annually:

Year 1-2: Has any infrastructure development started? Year 3-5: Are people building in the area? Are prices rising? Year 6-8: Is it time to sell, hold longer, or build? Year 9-10: Execute exit strategy

Be flexible. If development isn't happening as expected by Year 5, consider cutting losses and reallocating capital.

Step 8: Know When to Sell

Don't hold forever. Sell when:

Prices have appreciated 300-500% (take your win) Infrastructure has arrived (prices peak shortly after roads/utilities come) You need the capital for something better The area is fully developed (appreciation slows once area is mature)

Greed kills returns. If your ₦5M land is now worth ₦30M, sell. Don't wait for ₦50M and risk a market crash.

Red Flags: When NOT to Land Bank

Skip land banking if:

You need the money within 5 years (land is illiquid and slow to appreciate) You can't afford holding costs for 10+ years The area has no clear infrastructure plans Title documents are questionable You're buying purely based on someone's promise ("Trust me, this area will blow up") You can't visit Nigeria even once during the holding period You have high-interest debt in the US/UK/Canada (pay that off first)

Alternative: "Land Banking Lite" (Hybrid Approach)

Not ready for pure land banking? Try a hybrid:

Strategy: Buy land, hold 2-3 years, build a small structure, then sell or rent.

Benefits:

- Shorter holding period (reduces risk)

- Building on land prevents encroachment (no security costs)

- Can generate rental income while holding

- Easier to sell (completed structures sell faster than raw land)

Example:

- Buy land for ₦8M

- Build a 2-bedroom bungalow for ₦12M (total: ₦20M)

- Rent for ₦1.2M/year for 5 years = ₦6M

- Property appreciates to ₦35M

- Sell for ₦35M

- Net: ₦35M + ₦6M rent - ₦20M cost = ₦21M profit

vs Pure Land Banking:

- Buy land for ₦8M

- Hold 5 years with ₦3M in security costs

- Sell for ₦18M

- Net: ₦18M - ₦8M - ₦3M = ₦7M profit

Hybrid strategy tripled your profit while reducing risk.

Final Verdict: Is Land Banking Right for You?

Land banking works if: You have a 10-15 year investment horizon You pick high-growth locations based on research (not hype) You verify title documents thoroughly You can afford holding costs You understand it's illiquid (can't access money easily) You're okay with zero cash flow during holding period

Skip land banking if: You need cash flow or liquidity You can't afford to lock up money for 10 years You're risk-averse You don't understand Nigerian real estate market dynamics

For most diaspora investors, a hybrid approach makes more sense:

- 40% in rental properties (cash flow + appreciation)

- 30% in land banking (pure appreciation play)

- 30% in US/UK investments (diversification)

This balances growth, income, and risk.

Land banking isn't a money trap. But it's also not a guaranteed money printer.

It's a long-term, patient, research-intensive strategy that rewards those who understand growth patterns and avoid common pitfalls.

Choose wisely.

Interested in pre-vetted land banking opportunities with clear title? Explore our land listings or book a consultation to discuss your investment timeline and goals.