Is Abuja or Lagos Better for Diaspora Real Estate Investment in 2025?

Choosing between Lagos and Abuja for your Nigerian property investment? Here's the complete comparison: ROI, appreciation, infrastructure, and what works best for diaspora investors.

Your WhatsApp is blowing up.

Your friend in London just bought land in Lekki and won't stop talking about how it's going to 3× in value. Your cousin in New York bought in Abuja and swears it's the smarter investment because "it's the capital."

You're sitting in your Toronto apartment with $35,000 CAD saved up, ready to invest in Nigerian property. But you can't decide:

Lagos or Abuja?

The chaotic commercial capital with traffic that'll make you question your life choices? Or the planned, organized federal capital with better roads and less noise?

Both cities have serious potential. Both have diaspora investors making money. But they're completely different markets.

Let me break down exactly which city is better for YOUR specific investment goals—because the answer isn't one-size-fits-all.

The Tale of Two Cities: A Quick Overview

Before we dive into comparisons, let's establish what makes each city tick.

Lagos: The Commercial Powerhouse

- Population: 20-25 million (estimates vary, official census pending)

- Economy: Nigeria's commercial and financial hub, generates 30%+ of Nigeria's GDP

- Vibe: Fast-paced, chaotic, entrepreneurial, "Lagos hustle"

- Key Industries: Finance, tech, entertainment, maritime, trade

- Diaspora presence: Massive (especially Lekki, VI, Ikoyi)

Lagos is where money moves in Nigeria. It's New York, Los Angeles, and Miami rolled into one sweaty, traffic-jammed, opportunity-filled megacity.

Abuja: The Federal Capital

- Population: 3-4 million

- Economy: Government-driven, oil & gas headquarters, diplomacy

- Vibe: Planned, organized, cleaner, slower-paced

- Key Industries: Government, oil & gas corporate offices, international organizations

- Diaspora presence: Growing (especially Maitama, Asokoro, Gwarinpa)

Abuja is where power sits in Nigeria. It's like Washington DC—government contracts, political influence, and civil servants with stable income.

Now let's compare them across the factors that actually matter for diaspora investors.

Round 1: Property Appreciation Potential

Lagos Appreciation: Explosive but Location-Dependent

Lagos has produced some of the most dramatic real estate appreciation stories in Nigeria:

Example 1: Lekki Phase 1

- 2010: 500 sqm plot = ₦8-12 million

- 2025: Same plot = ₦80-120 million

- Appreciation: 900-1000% in 15 years

Example 2: Ajah/Sangotedo

- 2015: 500 sqm plot = ₦3-5 million

- 2025: Same plot = ₦18-30 million

- Appreciation: 500-600% in 10 years

But here's the catch: Not all Lagos areas appreciate equally.

- Lekki axis: Explosive growth

- Victoria Island/Ikoyi: Steady premium growth

- Mainland (Ikeja, Yaba, Surulere): Moderate growth

- Deep mainland/remote areas: Slow growth

Lagos appreciation is high-reward but requires picking the RIGHT area.

Abuja Appreciation: Steady and Predictable

Abuja's appreciation is less dramatic but more consistent:

Example 1: Gwarinpa

- 2010: 500 sqm plot = ₦4-6 million

- 2025: Same plot = ₦25-40 million

- Appreciation: 520-670% in 15 years

Example 2: Lugbe/Kuje

- 2015: 500 sqm plot = ₦2-3 million

- 2025: Same plot = ₦8-15 million

- Appreciation: 400-500% in 10 years

Abuja's appreciation is driven by:

- Government expansion

- Growing middle class (civil servants)

- Better urban planning (less chaos = more appeal)

- Improved infrastructure

Abuja appreciation is moderate-reward but more predictable.

Winner: Lagos (for maximum appreciation potential)

If you're willing to research and pick high-growth areas, Lagos offers bigger upside. But Abuja wins if you want safer, steadier growth.

Round 2: Rental Income Potential

Lagos Rental Yields: Higher Income, Higher Turnover

Lagos has stronger rental demand because:

- Larger population

- More expatriates and corporate tenants

- Booming tech and entertainment industries

- Short-let/Airbnb market is massive

Rental yield examples (2-bedroom apartment):

| Location | Purchase Price | Annual Rent | Yield |

|---|---|---|---|

| Lekki Phase 1 | ₦40M | ₦3.5-4M | 8.7-10% |

| Ajah | ₦20M | ₦1.8-2.5M | 9-12.5% |

| Yaba | ₦25M | ₦2-2.5M | 8-10% |

Short-let yields in Lagos: With good management, short-lets in prime areas can generate 12-18% annual yields.

But tenant issues are common:

- Late payments

- "I'll pay next month" excuses

- Difficult evictions

- Higher turnover

Abuja Rental Yields: Lower Income, More Stable Tenants

Abuja's rental market is different:

- Smaller population = less demand

- But tenants are often government workers (stable income)

- Corporate tenants from oil & gas (Shell, Chevron, etc.)

- Less short-let culture (more traditional annual leases)

Rental yield examples (2-bedroom apartment):

| Location | Purchase Price | Annual Rent | Yield |

|---|---|---|---|

| Maitama | ₦50M | ₦4-5M | 8-10% |

| Wuse 2 | ₦35M | ₦2.8-3.5M | 8-10% |

| Gwarinpa | ₦25M | ₦1.8-2.2M | 7.2-8.8% |

Advantages:

- Tenants pay more reliably (government salaries are predictable)

- Less turnover (people stay longer)

- Fewer "I forgot to pay rent" dramas

Disadvantages:

- Lower gross yields than Lagos

- Less short-let potential (not as much tourism/business travel)

Winner: Lagos (for higher rental income)

If you want maximum rental income and are okay managing tenant turnover, Lagos wins. If you want stable, reliable tenants with less drama, Abuja wins.

Round 3: Infrastructure and Livability

Lagos Infrastructure: Improving but Still Chaotic

The Good:

- Massive infrastructure investment (Lekki-Epe Expressway, Blue Line rail, etc.)

- Better internet (fiber optic widely available in choice areas)

- More international schools, hospitals, restaurants

- 24/7 economic activity

The Bad:

- Traffic is legendary (2-3 hours commute is normal)

- Flooding during rainy season (especially mainland, some Lekki areas)

- Power supply is inconsistent (budget heavily for generators)

- Overpopulated and crowded

For diaspora investors: If you're building a retirement home, can you handle Lagos traffic and chaos when you're 65? Or will you regret not choosing Abuja's calm?

Abuja Infrastructure: Cleaner, Organized, Better Roads

The Good:

- Well-planned city layout (Abuja actually has a master plan)

- Better roads (less traffic than Lagos, though growing)

- Cleaner environment

- Better power supply (relatively speaking)

- More organized waste management

The Bad:

- Less nightlife and entertainment

- Fewer international amenities

- Slower pace (if you love Lagos hustle, Abuja feels boring)

- Hot, dry climate (vs Lagos's coastal humidity)

For diaspora investors: If you're envisioning retirement or family visits, Abuja's livability is superior to Lagos.

Winner: Abuja (for quality of life)

If infrastructure and living conditions matter, Abuja is objectively better. But Lagos offers more excitement and economic opportunity.

Round 4: Ease of Property Management from Abroad

Lagos: More Service Providers, More Headaches

Advantages:

- Tons of property management companies (easier to find help)

- More contractors, architects, engineers

- Better technology (property tech startups are Lagos-based)

- Easier to monitor remotely (more CCTV/security options)

Disadvantages:

- More scammers targeting diaspora

- Contractor reliability issues

- Higher risk of theft/vandalism

- Omonile and land grabbing issues (especially Lekki outskirts, Ibeju-Lekki)

Abuja: Fewer Providers, Less Drama

Advantages:

- Less omonile nonsense (land grabbing is rarer)

- More straightforward transactions

- Tenants are more stable (less management needed)

- Government areas are safer (less theft/vandalism)

Disadvantages:

- Fewer property management companies

- Smaller pool of contractors

- Less tech-enabled monitoring solutions

- If something goes wrong, fewer options to fix it quickly

Winner: Tie

Lagos has more resources but more headaches. Abuja has fewer options but fewer problems. Pick your poison based on your risk tolerance.

Round 5: Investment Entry Cost

Lagos: Higher Entry Costs

Land prices (500 sqm):

- Lekki Phase 1: ₦60-100M ($38,000-$63,000 USD)

- Ajah/Sangotedo: ₦15-30M ($9,500-$19,000 USD)

- Ibeju-Lekki: ₦5-12M ($3,200-$7,600 USD)

- Epe: ₦3-8M ($1,900-$5,100 USD)

2-bedroom apartments:

- Lekki: ₦35-50M ($22,000-$32,000 USD)

- Ajah: ₦18-28M ($11,400-$17,700 USD)

- Yaba: ₦20-35M ($12,700-$22,200 USD)

Lagos is expensive, especially in prime areas.

Abuja: Lower Entry Costs (Relatively)

Land prices (500 sqm):

- Maitama/Asokoro: ₦80-150M ($50,000-$95,000 USD) - ultra-premium

- Wuse/Garki: ₦30-60M ($19,000-$38,000 USD)

- Gwarinpa: ₦15-30M ($9,500-$19,000 USD)

- Lugbe/Kuje: ₦4-10M ($2,500-$6,300 USD)

2-bedroom apartments:

- Maitama: ₦40-70M ($25,000-$44,000 USD)

- Gwarinpa: ₦20-35M ($12,700-$22,200 USD)

- Kubwa: ₦12-20M ($7,600-$12,700 USD)

Abuja's mid-range areas are slightly cheaper than Lagos's equivalent tiers.

Winner: Abuja (slightly more affordable)

For the same budget, you might get a larger property or better location in Abuja vs Lagos. But the difference isn't massive.

Round 6: Legal and Documentation Complexity

Lagos: More Bureaucracy, Faster Services

Challenges:

- Governor's Consent takes 6-12 months (sometimes longer)

- Lagos Land Registry is overwhelmed

- More documentation fraud (verify everything 3×)

Advantages:

- Lagos has digitized many land records (easier online verification)

- More lawyers specializing in real estate

- Better tech infrastructure for document processing

Abuja: Cleaner Process, Slower Bureaucracy

Challenges:

- FCT (Abuja) processes can be slow

- Fewer lawyers with deep expertise

- Less digitization (more manual processes)

Advantages:

- Fewer forged documents (smaller market = less fraud)

- More straightforward title verification

- Less omonile drama (so fewer legal complications)

Winner: Tie

Both have bureaucratic challenges. Lagos is more digitized but more fraud-prone. Abuja is cleaner but slower.

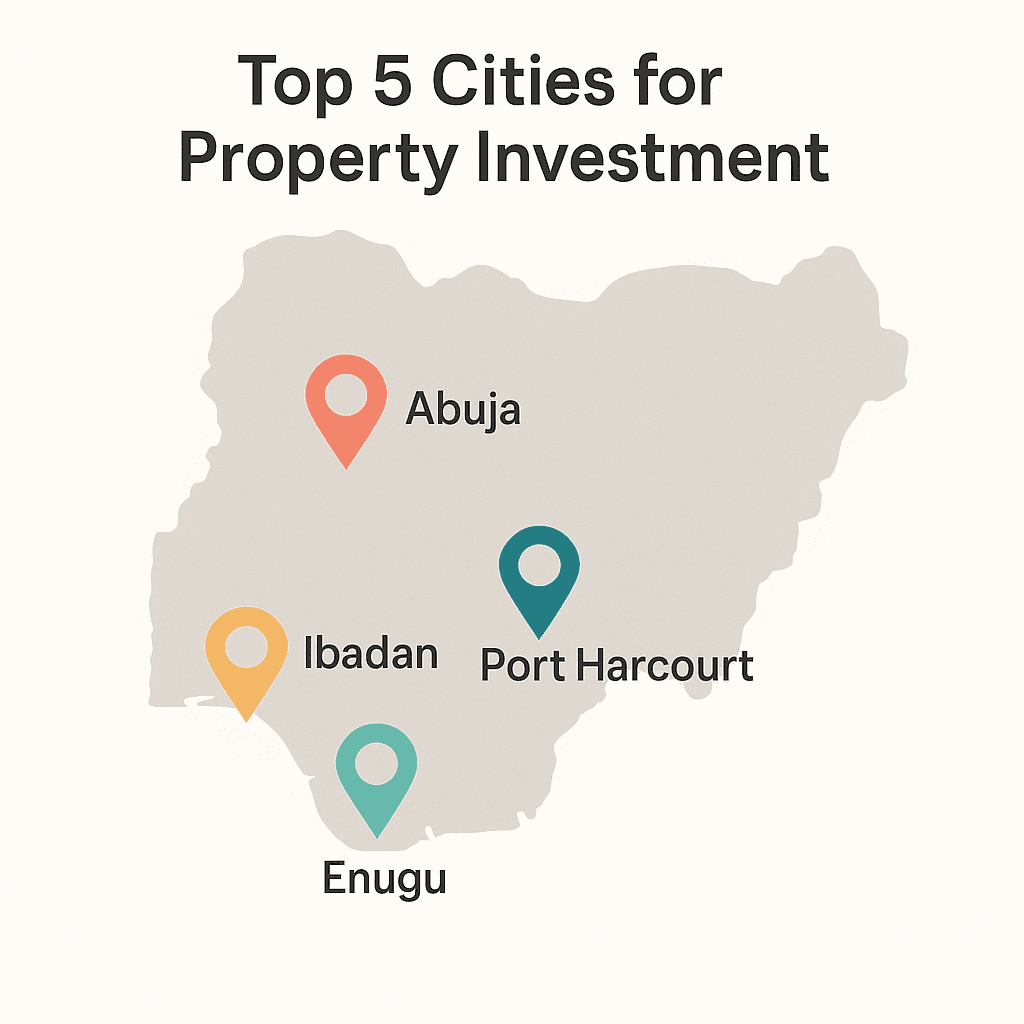

Round 7: Future Growth Potential

Lagos: Expanding Eastward and Northward

Growth areas to watch:

- Ibeju-Lekki: Lekki Free Trade Zone, Dangote Refinery, deep seaport

- Epe: Airport project, residential expansion

- Ajah/Sangotedo: Continued Lekki overflow

- Yaba: Tech hub development

Lagos is Nigeria's economic engine. As long as Nigeria's economy grows, Lagos grows.

Risks:

- Climate change (rising sea levels threaten coastal areas)

- Overpopulation (infrastructure can't keep up with population growth)

Abuja: Expanding to Satellite Towns

Growth areas to watch:

- Lugbe: Airport proximity, affordable housing

- Kuje: Residential expansion

- Suleja/Madalla: Niger State spillover from Abuja

- Karshi/Karu: Growing commercial interest

Abuja is still developing. As Nigeria's capital, government investment will continue.

Risks:

- Economic downturns hit Abuja harder (government spending drives economy)

- Slower private sector growth compared to Lagos

Winner: Lagos (higher growth potential)

Lagos's private-sector-driven economy is more resilient and faster-growing. Abuja's growth is tied to government spending.

The Verdict: Which City Should YOU Choose?

Here's the decision framework based on YOUR goals:

Choose Lagos If:

You want maximum capital appreciation (willing to research high-growth areas) You want higher rental income (especially short-let potential) You're okay with higher risk for higher reward You can handle property management challenges from abroad You're investing for medium-term flipping (5-10 years) You love the hustle, energy, and chaos You have family in Lagos who can help monitor

Best for: Aggressive investors chasing high returns

Choose Abuja If:

You want steady, predictable appreciation You prefer stable, reliable tenants (government workers) You want better quality of life (if building a retirement/vacation home) You value infrastructure and organization You want less omonile and land grabbing drama You're investing for long-term hold (10-20+ years) You prefer lower stress and fewer headaches

Best for: Conservative investors seeking stability

Consider Both If:

You have $60,000-$100,000+ to invest. Diversify:

- Buy land in Lagos (high appreciation potential)

- Buy apartment in Abuja (stable rental income)

Don't put all eggs in one basket.

Location-Specific Recommendations

If you've chosen your city, here are the best areas for diaspora investors:

Lagos - Top Areas for Diaspora:

For Maximum Appreciation:

- Ibeju-Lekki - Long-term land banking (5-10 years)

- Epe - Emerging area, high risk/high reward

- Ajah/Sangotedo - Mid-term growth (3-5 years)

For Rental Income:

- Lekki Phase 1 - Premium tenants, short-lets

- Ikate/Elegushi - High demand, good yields

- Yaba - Tech crowd, students, mid-income tenants

For Retirement/Family Home:

- VGC (Victoria Garden City) - Gated, organized, safe

- Magodo - Established, good infrastructure

- Ikeja GRA - Classic, well-developed

Abuja - Top Areas for Diaspora:

For Maximum Appreciation:

- Lugbe - Airport area, growing fast

- Kuje - Residential expansion

- Gwarinpa - Continued demand

For Rental Income:

- Wuse 2 - Commercial/residential mix

- Gwarinpa - Middle-class tenants

- Maitama - Premium tenants (if you have budget)

For Retirement/Family Home:

- Asokoro - Ultra-premium, calm, secure

- Maitama - Diplomatic area, organized

- Jabi/Utako - Good balance of price and quality

Real Stories from Diaspora Investors

Success Story 1: Lagos Land Banking

Investor: Tunde, UK-based nurse Investment: ₦8M land in Ajah (2016) Current value: ₦32M (2025) Result: 300% appreciation in 9 years

Tunde bought when the Lekki-Epe Expressway expansion was announced. Held through market fluctuations. Now building his retirement duplex.

Success Story 2: Abuja Rental Income

Investor: Ngozi, Canada-based accountant Investment: ₦22M 2-bedroom in Gwarinpa (2019) Annual rent: ₦2.2M (10% yield) Result: Stable income + appreciation to ₦30M

Ngozi wanted passive income without drama. Abuja delivered. Same tenant for 4 years, never missed rent.

Cautionary Tale: Lagos Omonile Nightmare

Investor: Emeka, US-based engineer Investment: ₦12M land in Ibeju-Lekki (2020) Problem: Omonile harassment, construction delays Resolution: Paid ₦800K in "settlements," finally completed

Emeka didn't do proper due diligence on omonile issues. Learned the hard way. Still worth it (land now ₦25M), but stressful.

Making Your Final Decision

Here's your action plan:

Step 1: Define Your Primary Goal

- Capital appreciation? → Lagos

- Stable income? → Abuja

- Retirement home? → Depends on lifestyle preference

Step 2: Assess Your Risk Tolerance

- High risk/high reward? → Lagos

- Low stress/predictable? → Abuja

Step 3: Consider Your Timeline

- 3-5 years? → Lagos (faster appreciation)

- 10-20 years? → Both work (Abuja edges for safety)

Step 4: Factor in Your Budget

- $15,000-$30,000 → Abuja might stretch further

- $40,000+ → Both cities offer prime options

Step 5: Think About Management

- Have family in Lagos? → Lagos easier

- No local connections? → Abuja simpler

Step 6: Visit Both (If Possible) Spend a few days in each city. Feel the energy. See the infrastructure. Talk to locals. Your gut will guide you.

Final Thoughts

There's no universally "better" city. Lagos and Abuja serve different investor profiles.

Lagos is the sprinter—fast, aggressive, high-reward, demanding attention.

Abuja is the marathon runner—steady, reliable, lower drama, easier pace.

Both will build wealth for diaspora investors. Both have risks. Both have opportunities.

The question isn't "which is better?" The question is "which is better for ME?"

Answer that honestly, and you've got your decision.

Want help identifying the right property in Lagos or Abuja for your goals? Book a free consultation and let's find your perfect investment.

Your Nigerian real estate journey starts with clarity. Now you have it.

Choose your city. Do your research. Build your wealth.

Which city did you choose for your investment? Share your reasoning in the comments. Let's help other diaspora investors make informed decisions.