Can You Get a Mortgage in Nigeria While Living Abroad? The Complete Guide

Living in the US, UK, or Canada and want a Nigerian mortgage? Here's everything about diaspora mortgages: rates, requirements, banks, and whether it's worth it.

You're earning $75,000 a year in Texas. Your credit score is 750. You could qualify for a US mortgage at 7% for 30 years.

But you want to buy property in Nigeria. You call a Nigerian bank: "Can I get a mortgage while living in the US?"

"Yes, we have diaspora mortgage products."

You get excited. Then they send the terms:

- Interest rate: 18% per year

- Repayment period: 10 years

- Down payment: 40% of property value

- Monthly income proof required

- Naira-denominated loan (you earn in dollars but pay in naira)

Suddenly, that excitement fades.

Is a Nigerian mortgage worth it? Can diaspora investors actually use them? And are there better alternatives?

Let me break it all down.

The Short Answer

Yes, you CAN get a mortgage in Nigeria while living abroad. Several Nigerian banks offer diaspora-specific mortgage products.

BUT—and this is important—Nigerian mortgages work very differently from US/UK/Canadian mortgages. The terms are often so unfavorable that most diaspora investors choose to save cash and buy outright instead.

Let's explore why.

How Nigerian Mortgages Differ from US/UK/Canada Mortgages

The Comparison

| Factor | US/UK/Canada Mortgage | Nigerian Diaspora Mortgage |

|---|---|---|

| Interest Rate | 6-8% annually | 15-22% annually |

| Repayment Period | 15-30 years | 5-15 years (typically 10) |

| Down Payment | 3-20% | 30-50% |

| Maximum LTV | 80-97% | 50-70% |

| Currency Risk | None (earn and pay in same currency) | High (earn in USD/GBP/CAD, pay in NGN) |

| Qualification | Credit score, income verification | Extensive docs, collateral, guarantors |

| Approval Time | 2-6 weeks | 2-6 months |

| Early Repayment Penalty | Usually none or minimal | Often 5-10% penalty |

The bottom line: Nigerian mortgages are shorter, more expensive, require larger down payments, and carry currency risk.

Which Nigerian Banks Offer Diaspora Mortgages?

Major Providers (2025)

1. GTBank Diaspora Mortgage

- Interest: 16-20% (depends on profile)

- Tenure: Up to 15 years

- Down payment: 30-40%

- Income requirement: Proof of foreign employment

- Special feature: Can service loan via domiciliary account

2. Access Bank Diaspora Home Loan

- Interest: 15-19%

- Tenure: Up to 10 years

- Down payment: 30%

- Income requirement: Minimum $30,000 annually

- Special feature: Fast-track processing for existing customers

3. First Bank Diaspora Property Scheme

- Interest: 17-21%

- Tenure: Up to 12 years

- Down payment: 40%

- Income requirement: Evidence of stable foreign income

- Special feature: Accepts properties in select "approved" areas only

4. Stanbic IBTC Diaspora Mortgage

- Interest: 16-19%

- Tenure: Up to 15 years

- Down payment: 30-35%

- Income requirement: Foreign salary account or regular remittances

- Special feature: Relationship pricing (better rates for existing wealth management clients)

5. Union Bank Diaspora Housing Loan

- Interest: 18-22%

- Tenure: Up to 10 years

- Down payment: 40%

- Income requirement: Proof of income via pay stubs or tax returns

- Special feature: Allows co-borrowing with spouse abroad

Smaller/Specialized Lenders

- FMBN (Federal Mortgage Bank): Lower rates (10-14%) but very bureaucratic, long processing times

- Abbey Mortgage Bank: Focuses on middle-income diaspora borrowers

- Infinity Trust Mortgage Bank: Emerging player with competitive rates

Real Example: What a Nigerian Diaspora Mortgage Looks Like

Let's run actual numbers.

Scenario:

- You live in London

- You want to buy a ₦40 million property (approx £25,000) in Lekki

- You apply for GTBank diaspora mortgage

Mortgage Terms:

- Property value: ₦40,000,000

- Down payment (35%): ₦14,000,000 (£8,750)

- Loan amount: ₦26,000,000 (£16,250)

- Interest rate: 18% annually

- Tenure: 10 years

Monthly Payment: Approximately ₦390,000 per month (£244)

Total Paid Over 10 Years: ₦46.8 million (£29,250)

Total Interest Paid: ₦20.8 million (£13,000)

You're paying ₦20.8M in interest on a ₦26M loan. That's 80% interest over 10 years.

Compare that to a UK mortgage at 6% over 25 years, where you'd pay maybe 40% of the loan amount in interest.

This is why many diaspora investors choose to save and buy cash.

The Hidden Costs and Risks

1. Currency Exchange Risk (The Big One)

You earn pounds, dollars, or Canadian dollars. Your mortgage is in naira.

The problem:

2020: £1 = ₦500 (your monthly ₦390K payment = £780) 2025: £1 = ₦1,600 (your monthly ₦390K payment = £244)

If naira strengthens, your payment gets cheaper in pound terms. If naira weakens further (likely), your payment gets more expensive.

Over 10 years, naira devaluation can dramatically increase your real cost.

Example:

- You budget £244/month based on current exchange rate

- Naira devalues 30% over 5 years

- Now the same ₦390K payment costs you £350/month

- Your mortgage just got 43% more expensive in real terms

Currency risk is unpredicable and can destroy your budget.

2. Early Repayment Penalties

Many Nigerian banks charge 5-10% penalties if you pay off your mortgage early.

Scenario:

- You get a bonus at work and want to pay off your remaining ₦15M loan

- Bank charges 7% early repayment fee

- You pay ₦1.05M ($670) just for the privilege of paying off YOUR OWN DEBT early

This is insane compared to US/UK markets where early repayment is usually free or has minimal fees.

3. Property Restrictions

Banks won't finance just any property. They typically require:

- Property in "approved" areas (usually established neighborhoods, not developing areas)

- Properties with clear title (C of O, Governor's Consent)

- Properties meeting minimum value thresholds

- Properties that can easily be resold if you default

This means:

- You can't finance land banking in Ibeju-Lekki (bank sees it as too risky)

- You can't finance small properties under ₦15-20M

- You can't finance properties in certain areas banks deem "unapproved"

Your investment options are limited.

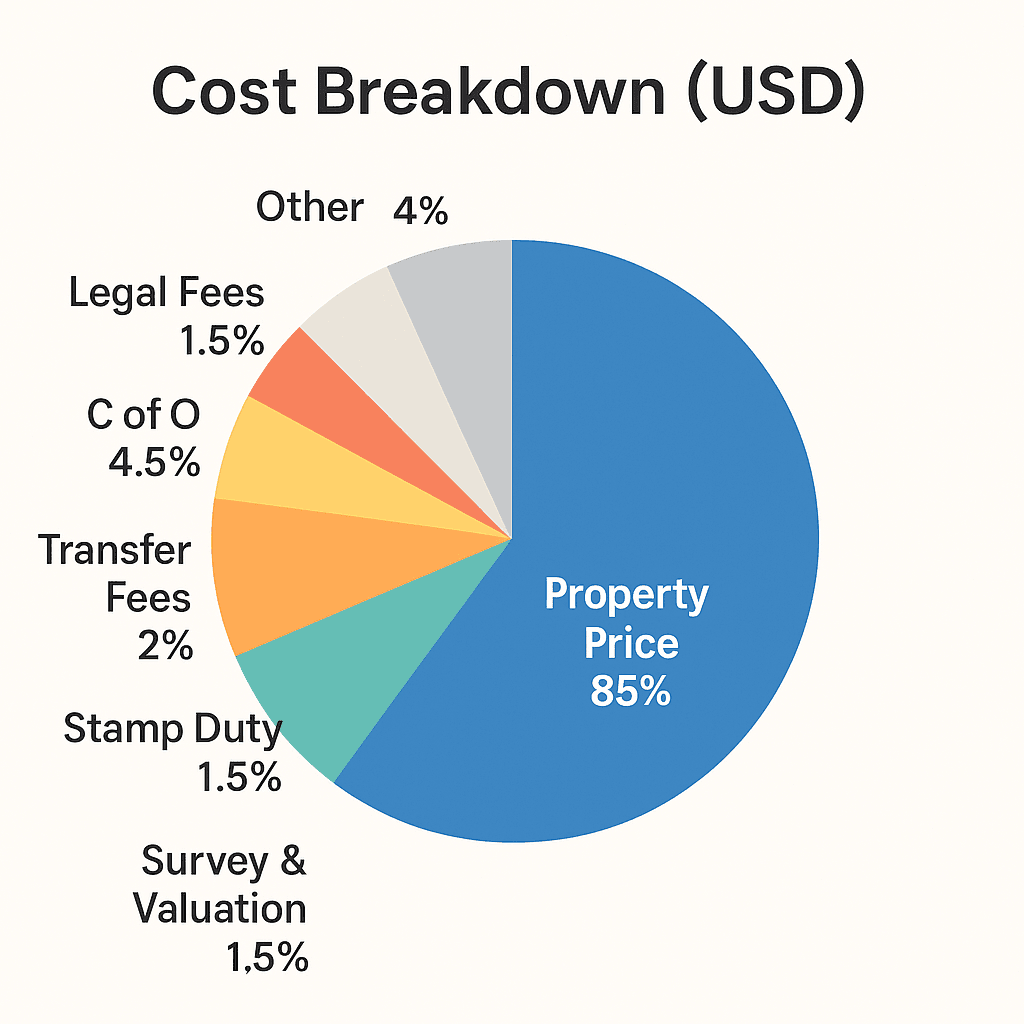

4. Processing Fees and Charges

Beyond interest, expect:

- Application fee: ₦50,000-₦150,000

- Valuation fee: ₦150,000-₦300,000

- Legal fees: ₦200,000-₦500,000

- Insurance (building and life): ₦200,000-₦400,000 annually

- Processing/administrative fees: ₦100,000-₦300,000

Total upfront costs: ₦700,000-₦1.65 million ($500-$1,100 USD)

That's on top of your 30-40% down payment.

5. Lengthy Approval Process

Unlike US mortgages (approved in 2-6 weeks), Nigerian diaspora mortgages can take:

- 2-4 months for documentation and approval

- Another 1-2 months for disbursement

- Total: 3-6 months from application to getting your money

If you're trying to close on a property quickly, this kills the deal.

When Does a Nigerian Mortgage Make Sense?

Despite all the negatives, there ARE scenarios where a diaspora mortgage might be worth it:

Scenario 1: You Have Some Cash But Not Enough

Example:

- Property costs ₦40M ($25,000)

- You have $10,000 saved

- You could wait 3 years to save the other $15,000

- OR you get a mortgage now, pay higher interest, but start building equity immediately

Trade-off: Higher interest cost vs 3 years of opportunity cost (property might appreciate 30-50% during those 3 years).

If property appreciation exceeds your mortgage interest cost, the mortgage wins.

Scenario 2: You Want to Preserve Foreign Currency Cash

Example:

- You have $40,000 in the US

- You want to buy ₦50M ($32,000) property in Nigeria

- You don't want to deplete your US emergency fund

Strategy:

- Put down 40% (₦20M = $12,800)

- Finance ₦30M via Nigerian mortgage

- Keep $27,200 in US as emergency fund / other investments

Benefit: You maintain liquidity in hard currency while building Nigerian asset.

Scenario 3: You're Confident in Naira Stability (Rare)

If you somehow believe naira will strengthen or remain stable (most economists disagree), then a naira-denominated mortgage becomes less risky.

Unlikely, but possible.

Scenario 4: Your Nigerian Rental Income Covers the Mortgage

Example:

- You buy ₦40M property with mortgage

- You rent it for ₦400,000/month

- Your mortgage payment is ₦390,000/month

- Tenant pays your mortgage

Benefits:

- You're building equity with someone else's money (the tenant's rent)

- You only needed 30-40% down payment instead of 100% cash

- After 10 years, you own the property free and clear

Risks:

- Tenant doesn't pay/vacancy

- Property maintenance costs

- Currency risk if you need to supplement from abroad

This is the BEST use case for diaspora mortgages.

The Alternative: Save Cash and Buy Outright

Let's compare the total cost:

Option A: Mortgage

- Property: ₦40M

- Down payment: ₦14M (35%)

- Loan: ₦26M at 18% for 10 years

- Total paid: ₦14M + ₦46.8M = ₦60.8M

- Total cost: ₦60.8M ($38,000 USD)

Option B: Save and Buy Cash

- Save for 2 years

- Buy property cash for ₦40M ($25,000)

- Total cost: ₦40M ($25,000)

You save ₦20.8M ($13,000 USD) by waiting 2 years.

BUT: If the property appreciates ₦15M during those 2 years, your opportunity cost is ₦15M.

Net: You saved ₦5.8M by getting the mortgage.

The math depends on:

- How fast property is appreciating

- How long you'd need to save

- What else you could do with that cash

How to Apply for a Nigerian Diaspora Mortgage

If you've decided a mortgage makes sense for your situation, here's the process:

Step 1: Choose Your Bank

Research at least 3 banks. Compare:

- Interest rates

- Repayment terms

- Approved property areas

- Processing fees

- Customer service (are they responsive to diaspora clients?)

Don't just go with the bank you have an account with. Shop around.

Step 2: Gather Required Documents

Typical requirements:

- Valid passport

- Proof of foreign residency (visa, residence permit, etc.)

- Employment letter from your foreign employer

- 3-6 months of pay stubs

- Foreign bank statements (3-6 months)

- Tax returns (1-2 years)

- Nigerian ID or BVN (Bank Verification Number)

- Proof of address abroad

Start gathering these early. Getting documents notarized, apostilled, and sent to Nigeria takes time.

Step 3: Property Identification

Find and reserve the property you want to buy. The bank will:

- Send a valuer to assess the property

- Verify the title documents

- Confirm the property is in an "approved" area

- Ensure the property value matches what you're claiming

Bank valuation might come in lower than seller's asking price. Be prepared to negotiate or increase your down payment.

Step 4: Submit Application

- Complete bank's mortgage application forms

- Submit all documents

- Pay application fee

Processing starts. Expect 2-4 months.

Step 5: Approval and Offer Letter

If approved, the bank issues an offer letter stating:

- Loan amount

- Interest rate

- Repayment schedule

- Fees and charges

- Conditions (insurance, legal requirements, etc.)

Review carefully with a lawyer before accepting.

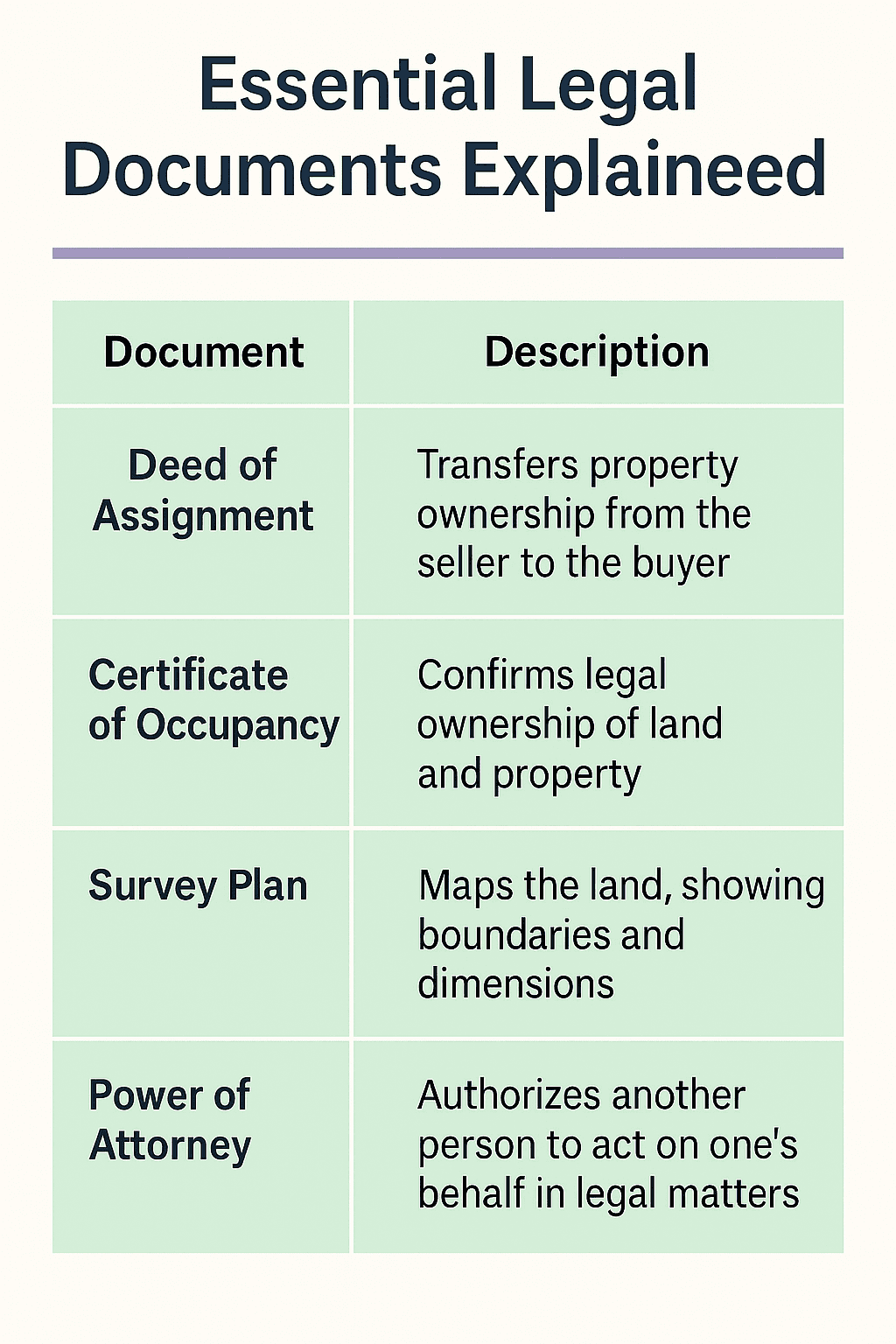

Step 6: Legal Documentation

The bank's lawyer and your lawyer will:

- Draft/review the mortgage agreement

- Create a Legal Mortgage (registered at the Land Registry)

- Verify title documents

- Obtain Governor's Consent

This step alone can take 1-3 months.

Step 7: Disbursement

Once all legal docs are signed:

- You pay your down payment to the seller (via escrow)

- Bank disburses the loan amount to the seller

- Property title is transferred to you (with bank's mortgage lien)

Step 8: Repayment

- Set up a domiciliary account in Nigeria (USD/GBP/CAD account)

- Fund it monthly from abroad

- Bank auto-debits naira equivalent for your monthly payment

Total timeline from application to getting the property: 4-8 months.

Insider Tips for Diaspora Mortgage Success

Tip 1: Negotiate Everything

Interest rates, processing fees, valuation fees—everything is negotiable, especially if you:

- Have substantial deposits with the bank

- Are willing to move salary/investments to the bank

- Have excellent foreign credit history

- Are borrowing a large amount

Don't accept the first offer. Banks expect negotiation.

Tip 2: Consider Shorter Tenure

Counter-intuitive, but hear me out:

10-year mortgage at 18%: Monthly payment ₦390K, total interest ₦20.8M 5-year mortgage at 18%: Monthly payment ₦660K, total interest ₦13.6M

You save ₦7.2M ($4,500) by doubling your monthly payment and halving the tenure.

If you can afford higher monthly payments, shorter tenure dramatically reduces total interest.

Tip 3: Build a Strong Relationship with the Bank First

Before applying for a mortgage:

- Open an account

- Start making regular deposits/transfers

- Use the bank's investment products (if you're comfortable)

- Become a "valuable customer"

Banks give better rates and faster processing to existing valued customers.

Tip 4: Have a Lawyer Review Everything

Nigerian mortgage agreements are complex and filled with clauses that favor the bank.

Pay ₦200,000-₦500,000 for a good property lawyer to:

- Review the mortgage agreement

- Negotiate unfavorable clauses

- Ensure you understand all terms

- Verify the legal mortgage is properly registered

Worth every kobo.

Tip 5: Budget for Currency Swings

If your ₦390K monthly payment is £244 today, budget for £350/month to cushion against naira devaluation.

Don't budget at the edge. Give yourself a 30-40% buffer.

Alternatives to Nigerian Bank Mortgages

Alternative 1: US/UK/Canada Home Equity Loan

If you own property abroad, borrow against that equity instead:

- Interest: 6-10% (much better than Nigeria's 18%)

- Tenure: 10-30 years (more flexible)

- No currency risk (borrow and earn in same currency)

- Faster approval

Use the borrowed funds to buy Nigerian property cash.

Read our guide on financing options from abroad.

Alternative 2: Personal Loan (US/UK/Canada)

Take an unsecured personal loan abroad at 8-15% and use it to buy Nigerian property.

Pros: Faster, no property collateral, no Nigerian bank bureaucracy Cons: Higher interest than home equity, lower maximum amounts

Alternative 3: Developer Financing

Some Nigerian property developers offer installment payment plans:

- Pay 30% upfront

- Pay remaining 70% over 12-24 months in installments

- Interest-free or low interest (5-10%)

Much better than bank mortgages for properties still under construction.

Alternative 4: Partnership/Pooled Investment

Pool money with family/friends to buy property cash (no debt).

Example:

- You put in $15,000

- Your sibling puts in $15,000

- You buy ₦37.5M property together

- Co-own and split appreciation/rental income

No interest, no debt, but requires trust and clear legal agreements.

Final Verdict: Should You Get a Nigerian Mortgage?

Get a Nigerian diaspora mortgage if: You have substantial savings but not enough for full cash purchase The property is generating rental income that covers mortgage payments You want to preserve foreign currency liquidity Property appreciation in the area is 20%+ annually (exceeds mortgage interest) You can afford 30-50% currency buffer in your budget You understand and accept the risks

Skip the Nigerian mortgage if: You can save and buy cash within 12-24 months You're risk-averse about currency fluctuations You have access to cheaper financing abroad (home equity, personal loans) You're buying land for future development (banks won't finance this) The property won't generate rental income You can't afford 40% down payment + fees

For most diaspora investors, the math favors saving cash or using cheaper foreign financing.

But for rental income properties or when you need to act fast on a high-appreciation opportunity, diaspora mortgages can work.

Know your numbers. Understand your risks. Choose wisely.

Want help identifying rental properties that can cover their own mortgage payments? Or need advice on whether a mortgage makes sense for your situation? Book a free consultation.

Disclaimer: Mortgage terms change frequently. Contact banks directly for current rates and requirements. This article provides general information, not financial advice. Consult with financial advisors before making decisions.*