Can You Buy a House in Nigeria from the US?

Learn how Nigerians living abroad can buy property in Nigeria safely from the United States — including costs, legal steps, and essential documents.

Every day, thousands of Nigerians abroad dream of a future where they can return home — not just to visit, but to own a piece of it. From London to Houston to Toronto, the Nigerian diaspora is quietly building wealth, not only where they live but where they come from.

According to the World Bank, Nigeria received over $20 billion in remittances in 2024, the highest in Africa. What's changing is where that money is going — not just into consumption, but into real estate, business, and legacy building.

Buying property back home isn't just about investment returns — it's about belonging.

Key Steps to Buy a House in Nigeria from the US

1. Find the Right Property

Start by searching for properties through Nigerian real estate agencies, international platforms, or local contacts.

Ensure the seller has the legal right to transfer ownership.

2. Verify the Property and Seller

Confirm the validity of the Certificate of Occupancy (C of O) and seller's ownership.

Hire a local lawyer or real estate agent to ensure due diligence.

3. Make the Payment

Use secure international money transfer services such as Wise, PayPal, or Remitly.

Be mindful of exchange rates and transaction fees.

4. Complete Legal Formalities

A notarized purchase agreement and C of O are required to register the property in your name.

Some states may require Governor's approval — your lawyer will guide you.

5. Register the Property

After purchase, register the property at the State Land Registry.

You'll receive your Certificate of Occupancy (C of O) — proof of ownership.

Complete Cost Breakdown for US-Based Buyers

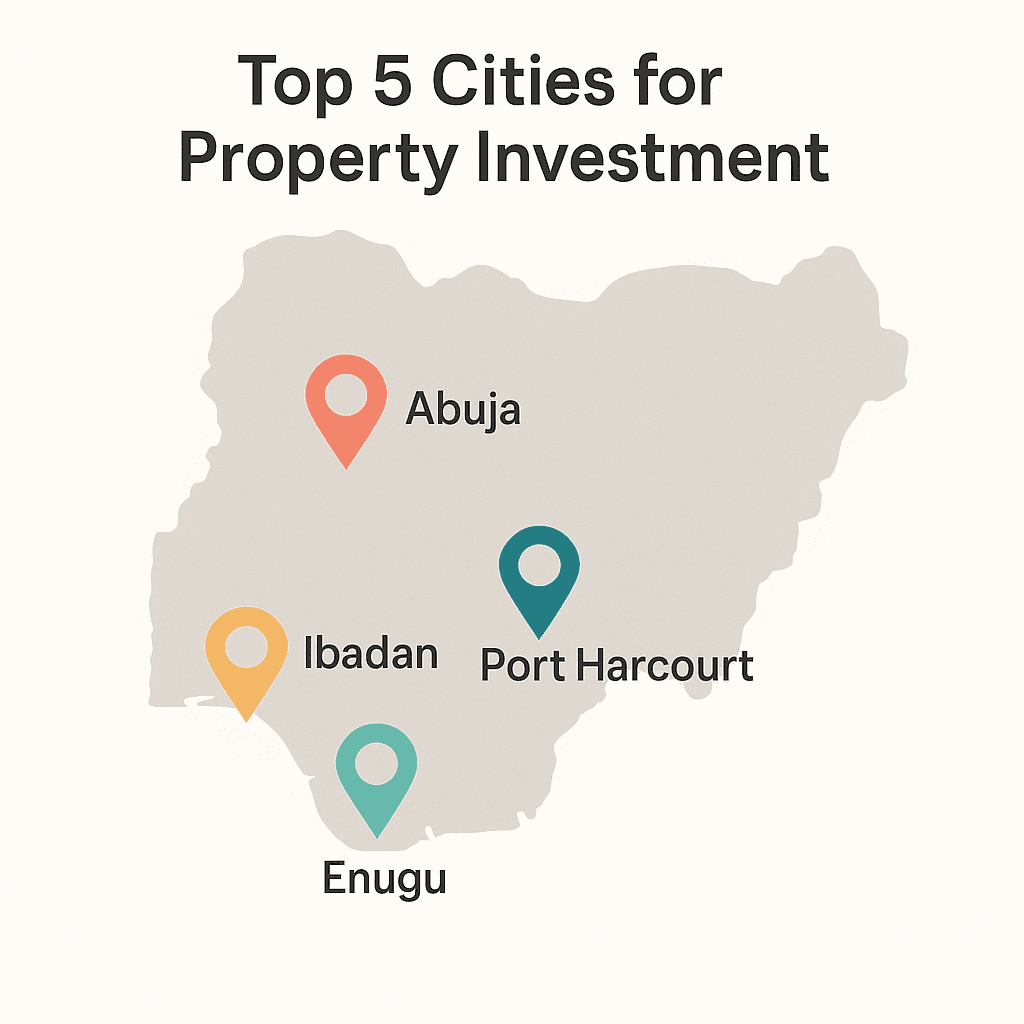

Property Prices (2025) in USD Equivalent

| City | 3-Bedroom Apartment | 4-Bedroom Duplex | Detached House |

|---|---|---|---|

| Lagos | $17,000 – $67,000 (mid) $42,000 – $167,000 (premium) |

$42,000 – $250,000+ | $67,000 – $417,000+ |

| Abuja | $13,000 – $50,000 (suburbs) $33,000 – $125,000 (city) |

$29,000 – $167,000+ | $50,000 – $333,000+ |

| Port Harcourt | $10,000 – $38,000 | $21,000 – $83,000+ | $33,000 – $167,000+ |

| Ibadan | $7,000 – $23,000 | $13,000 – $50,000 | $21,000 – $83,000 |

| Enugu | $8,000 – $29,000 | $17,000 – $58,000 | $25,000 – $100,000 |

Complete Transaction Costs (Example: $50,000 Property in Lagos)

| Cost Category | Naira Amount | USD Equivalent | Details |

|---|---|---|---|

| Property Price | ₦60,000,000 | $50,000 | Base property cost |

| Legal Fees | ₦600,000 – ₦1,000,000 | $500 – $833 | Lawyer and documentation |

| Certificate of Occupancy (C of O) | ₦800,000 – ₦1,500,000 | $667 – $1,250 | If property doesn't have one |

| Governor's Consent | ₦900,000 – ₦1,200,000 | $750 – $1,000 | Required for ownership transfer |

| Transfer/Registration Fees | ₦1,200,000 (2%) | $1,000 | Paid to Land Registry |

| Stamp Duty | ₦900,000 (1.5%) | $750 | Government tax |

| Survey & Valuation | ₦400,000 – ₦600,000 | $333 – $500 | Property assessment |

| Agent Commission (optional) | ₦1,800,000 (3%) | $1,500 | For agent services |

| Subtotal (Fees) | ₦6.6M – ₦8.2M | $5,500 – $6,833 | 11-14% of property price |

| Total Cost | ₦66.6M – ₦68.2M | $55,500 – $56,833 | Property + All Fees |

Money Transfer Options & Costs

| Service | Fee Structure | Exchange Rate | Speed | Best For |

|---|---|---|---|---|

| Wise (TransferWise) | 0.5% – 1.5% | Near market rate | 1-3 days | Best overall value |

| Western Union | $20 – $50 flat | Below market rate | Same day | Urgent transfers |

| Bank Wire Transfer | $25 – $75 | Below market rate | 2-5 days | Large amounts |

| Remitly | 0.5% – 2% | Near market rate | 1-3 days | Good alternative |

Pro Tip: For a $50,000 transfer, using Wise could save you $1,000-2,000 compared to traditional bank wires.

Critical Considerations for US-Based Buyers

1. Power of Attorney (POA) - Your Most Important Tool

Since you're buying remotely, you'll need a reliable representative in Nigeria:

What is a POA?

A legal document giving someone authority to act on your behalf in property transactions.

Types of POA:

- General POA: Broad powers (use with extreme caution)

- Special/Specific POA: Limited to specific transaction (recommended)

- Durable POA: Remains valid even if you become incapacitated

How to Create a Valid POA from the US:

- Draft the POA document with a Nigerian lawyer

- Notarize it at a US Notary Public

- Get it authenticated at the Nigerian Embassy/Consulate in the US

- Send original to your representative in Nigeria

- Representative registers it at the appropriate Nigerian court

Recommended Representatives:

- Licensed Nigerian real estate lawyers (safest)

- Immediate family members you deeply trust

- Professional property firms with track records

- Never: Distant relatives, online acquaintances, or unverified agents

2. US Tax Implications You Must Know

IRS Reporting Requirements:

- Foreign bank accounts over $10,000: File FBAR (FinCEN Form 114)

- Foreign assets over $50,000: File Form 8938

- Nigerian rental income: Report on US tax return (Schedule E)

Tax Treaties:

- US-Nigeria tax treaty prevents double taxation

- Nigerian property tax can offset US tax liability

- Consult CPA familiar with international real estate

Capital Gains:

- US taxes foreign property gains same as domestic

- Hold for 1+ year for long-term capital gains rates (15-20%)

- Track all improvement costs to reduce taxable gains

3. Currency Strategy

Exchange Rate Volatility:

- ₦380/$1 (2020) → ₦1,200/$1 (2025)

- Naira depreciation makes Nigerian real estate cheaper for USD holders

- Time transfers when exchange rates are favorable

Smart Currency Tactics:

- Don't convert entire amount at once

- Use rate alerts (Google Finance, Xe.com)

- Consider hedging strategies for large purchases

- Transfer in tranches as payment milestones are met

4. Remote Property Management

If buying for investment/rental:

Property Management Options:

| Option | Cost | Pros | Cons |

|---|---|---|---|

| Professional Firm | 10-15% of rent | Full service, vetted tenants | Higher cost |

| Family Member | Variable/free | Trust factor | Can strain relationships |

| Estate Management | Included in service charge | Convenient if in estate | Limited scope |

Key Services Needed:

- Tenant screening and rent collection

- Property maintenance and repairs

- Utility bill payments

- Periodic photo/video updates

- Annual tax payments

What Documents Are Needed?

When buying a property in Nigeria, the following are required:

- A valid ID (driver's license, national ID, or passport)

- Certificate of Occupancy (C of O) or Governor's Consent

- Authenticated Survey Plan

- Deed of Assignment or Agreement of Sale

- Payment receipt for Stamp Duty

- Letter of Allocation (if applicable)

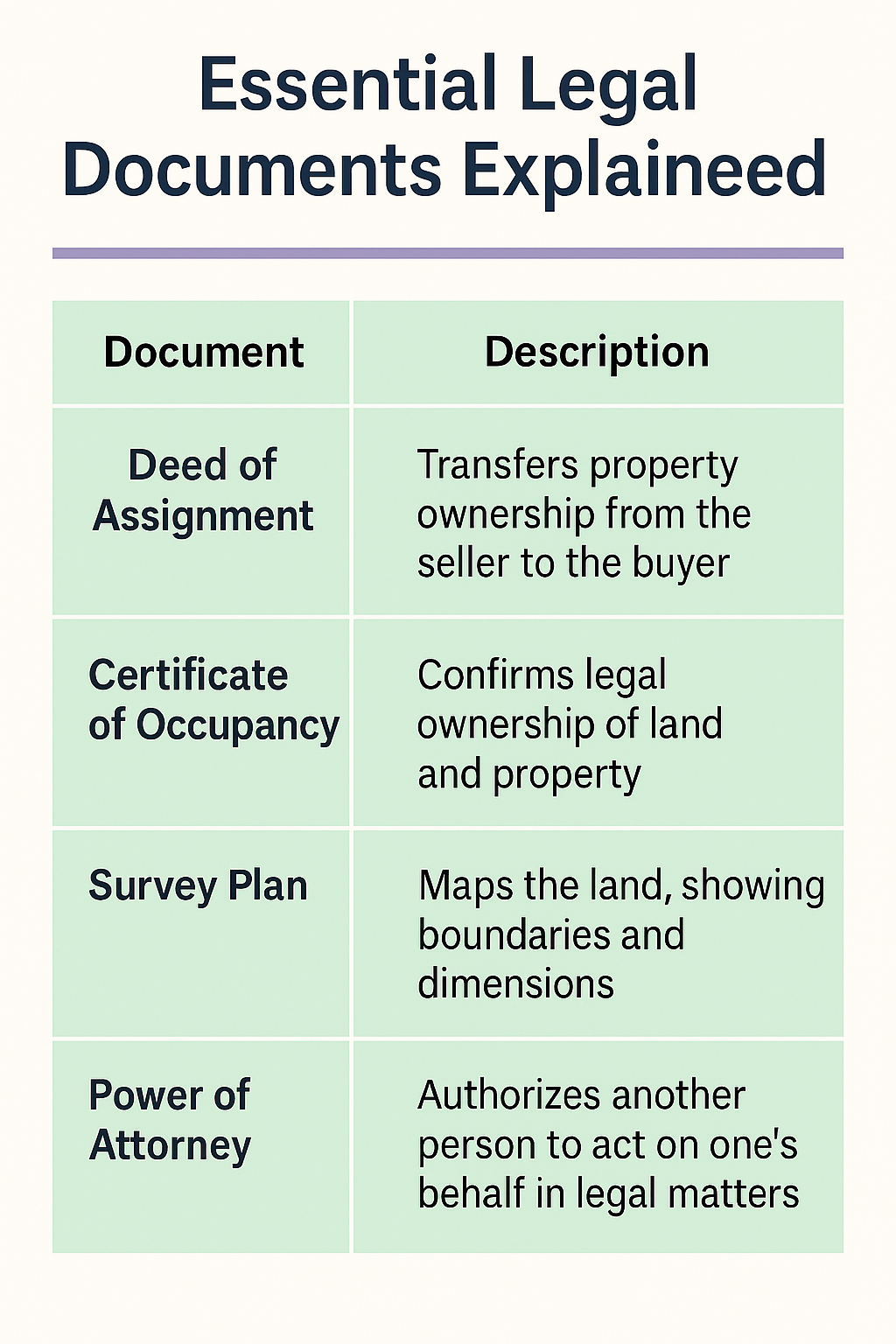

The Essential Legal Documents (Explained)

| Document | What It Does | Issued By |

|---|---|---|

| Survey Plan | Defines boundaries of the land | Licensed Surveyor |

| Deed of Assignment | Transfers ownership legally | Property Seller |

| Certificate of Occupancy (C of O) | Recognizes ownership | State Government |

| Governor's Consent | Approves land transfer | Ministry of Lands |

| Purchase Receipt | Confirms payment | Seller or Developer |

Common Scams & How to Avoid Them

Red Flags to Watch For:

-

"Omo Onile" (Land Grabbers)

- Scam: Claiming ownership of legitimately purchased land

- Protection: Buy only titled properties, verify at land registry, use properties in established estates

-

Fake Documents

- Scam: Forged C of O, survey plans, receipts

- Protection: Verify all documents at State Land Registry, use forensic document examination

-

Double Allocation

- Scam: Same land sold to multiple buyers

- Protection: Conduct thorough title search, physical site inspection, check for existing structures

-

"Family Land" Issues

- Scam: One family member sells land without others' consent

- Protection: Insist on meeting all family members, get letter of consent from all, use family lawyers

-

Advance Fee Fraud

- Scam: Requesting full payment before showing proper documents

- Protection: Never pay until documents are verified, use escrow services, pay in installments tied to milestones

Verification Checklist:

- Confirm developer is LASRERA/LASREA registered (Lagos)

- Verify lawyer is NBA (Nigerian Bar Association) licensed

- Check property location on Google Maps (is it water/swamp?)

- Get video calls from the property site

- Speak with current residents/neighbors

- Check online reviews and forum discussions

- Verify bank account belongs to company, not individual

- Request references from previous diaspora clients

FAQs: Buying Property in Nigeria from the US

Can I buy property in Nigeria without visiting?

Yes, through a Special Power of Attorney and verified lawyer. However, visiting before final payment is strongly recommended.

How long does the entire process take?

6-12 months typically: 2-3 months (search & verification), 2-3 months (documentation), 2-6 months (Governor's Consent).

What's the minimum investment?

You can find properties from $7,000 (Ibadan suburbs) to $500,000+ (Lagos premium). Most diaspora start with $20,000-50,000 range.

Can I get a US mortgage for Nigerian property?

No. US banks don't finance foreign properties. Options: Nigerian diaspora mortgages, developer payment plans, or cash purchase.

What about rental income - how do I collect it from the US?

Use property managers who transfer funds to your Nigerian bank account, then wire to US. Or use services like Wise for lower fees.

Are there restrictions on repatriating funds?

No legal restrictions, but Nigerian banks may require documentation for large transfers. Keep all property purchase receipts.

Can I use my Nigerian rental income to qualify for US mortgage?

Yes, but must show 2+ years of Nigerian rental income on US tax returns. Most lenders require verification.

What if my relative/POA holder betrays me?

Use "Special POA" limited to specific transaction only. Document everything. Never give general POA. Use licensed professionals over relatives when possible.

Is property insurance necessary?

Not mandatory but highly recommended. Costs ₦50,000-300,000/year. Covers fire, theft, structural damage.

Can I will my Nigerian property to my US-born children?

Yes, Nigerian property can be included in your will and inherited by anyone regardless of nationality.

Step-by-Step Action Plan for US-Based Buyers

Phase 1: Preparation (1-2 months)

- Define your budget (in USD, factor in 14% additional costs)

- Choose target city and neighborhoods

- Research current market prices

- Identify 2-3 reputable real estate companies/developers

- Find a licensed Nigerian property lawyer (ask for bar number)

- Set up method for money transfers

Phase 2: Property Search & Verification (2-3 months)

- Request property listings with videos/virtual tours

- Schedule video calls to view properties

- Narrow down to 2-3 options

- Lawyer conducts title search at Land Registry

- Get independent property valuation

- Check with neighbors/estate residents (via video call)

- Ideally, visit Nigeria to see shortlisted properties in person

Phase 3: Legal Documentation (2-3 months)

- Negotiate price (10-15% negotiation margin is normal)

- Sign Agreement of Sale (lawyer reviews first)

- Make initial deposit (typically 30%)

- Lawyer prepares all legal documents

- Create and notarize Power of Attorney (if needed)

- Transfer funds for balance payment

- Sign Deed of Assignment (or have POA holder sign)

Phase 4: Registration & Transfer (3-6 months)

- Apply for Governor's Consent

- Pay all government fees

- Register property at Land Registry

- Receive Certificate of Occupancy (C of O)

- Set up property management (if rental)

- Get property insurance

- Register with estate association

Final Thoughts

Buying property in Nigeria from the US is not only possible but increasingly common as the diaspora seeks to build wealth back home. The combination of favorable exchange rates, high rental yields (6-12%), and strong appreciation (10-25% annually) makes Nigerian real estate attractive to US-based Nigerians.

Keys to Success:

- Do Your Homework: Research extensively before committing

- Verify Everything: Trust, but verify all documents and people

- Use Professionals: Licensed lawyers and LASRERA-registered developers only

- Start Small: Consider your first purchase a learning experience

- Visit If Possible: Nothing beats seeing the property in person

- Plan Long-Term: Real estate is a 5-10 year investment, not a quick flip

- Stay Involved: Regular communication with your team in Nigeria

The Nigerian real estate market offers genuine opportunities for wealth creation, but success requires diligence, patience, and working with the right professionals. Thousands of diaspora Nigerians have successfully bought property from abroad — with proper guidance and precautions, you can too.

Your Next Steps:

- Determine your investment budget

- Download our diaspora property buyer checklist

- Schedule a consultation with our diaspora specialists

- Connect with vetted property lawyers and developers

- Start your property search with confidence

Written by: Chioma Chukwueze

Helping Nigerians abroad invest safely at home.