How Much Does It Cost to Buy a House in Nigeria?

Get the full breakdown of house prices in Nigeria — from Lagos to Abuja — including costs by property type, legal fees, taxes, and expert insights for homebuyers.

Buying a house in Nigeria can cost anywhere from ₦500,000 for rural properties to over ₦500 million for luxury homes in high-end areas.

Let's break down the factors, average prices, and hidden costs you should expect in 2025.

Average House Prices by City and Property Type (2025)

| City | 3-Bedroom Apartment | 4-Bedroom Duplex | Detached House |

|---|---|---|---|

| Lagos (Mid-range) | ₦20M – ₦80M | ₦50M – ₦300M+ | ₦80M – ₦500M+ |

| Lagos (Premium) | ₦50M – ₦200M+ | ₦100M – ₦500M+ | ₦200M – ₦1B+ |

| Abuja (Suburbs) | ₦15M – ₦60M | ₦35M – ₦200M+ | ₦60M – ₦400M+ |

| Abuja (City Center) | ₦40M – ₦150M | ₦80M – ₦350M+ | ₦150M – ₦600M+ |

| Port Harcourt | ₦12M – ₦45M | ₦25M – ₦100M+ | ₦40M – ₦200M+ |

| Ibadan | ₦8M – ₦28M | ₦15M – ₦60M | ₦25M – ₦100M |

| Enugu | ₦10M – ₦35M | ₦20M – ₦70M | ₦30M – ₦120M |

Price Breakdown by Neighborhood Type:

- Ultra-Premium (Ikoyi, Banana Island, Maitama): ₦200M – ₦1B+

- Premium (Lekki Phase 1, VI, Asokoro, Guzape): ₦50M – ₦300M

- Mid-Range (Ajah, Sangotedo, Lugbe, Bodija): ₦15M – ₦80M

- Emerging/Affordable (Ibeju-Lekki, Kuje, Moniya): ₦8M – ₦40M

Note: These are 2025 market prices. Lagos and Abuja command premium prices due to infrastructure, security, and high demand. Prices have increased 40-60% since 2020 due to inflation and Naira devaluation.

What Drives Property Prices?

- Location: Prime areas (like Ikoyi or Maitama) are far more expensive.

- Property Type: Duplexes and detached homes cost more than apartments.

- Land Title: Properties with valid C of O or Governor's Consent carry premium value.

- Infrastructure: Proximity to power, water, and roads adds to the price.

- Market Demand: Population growth and urban migration push values upward.

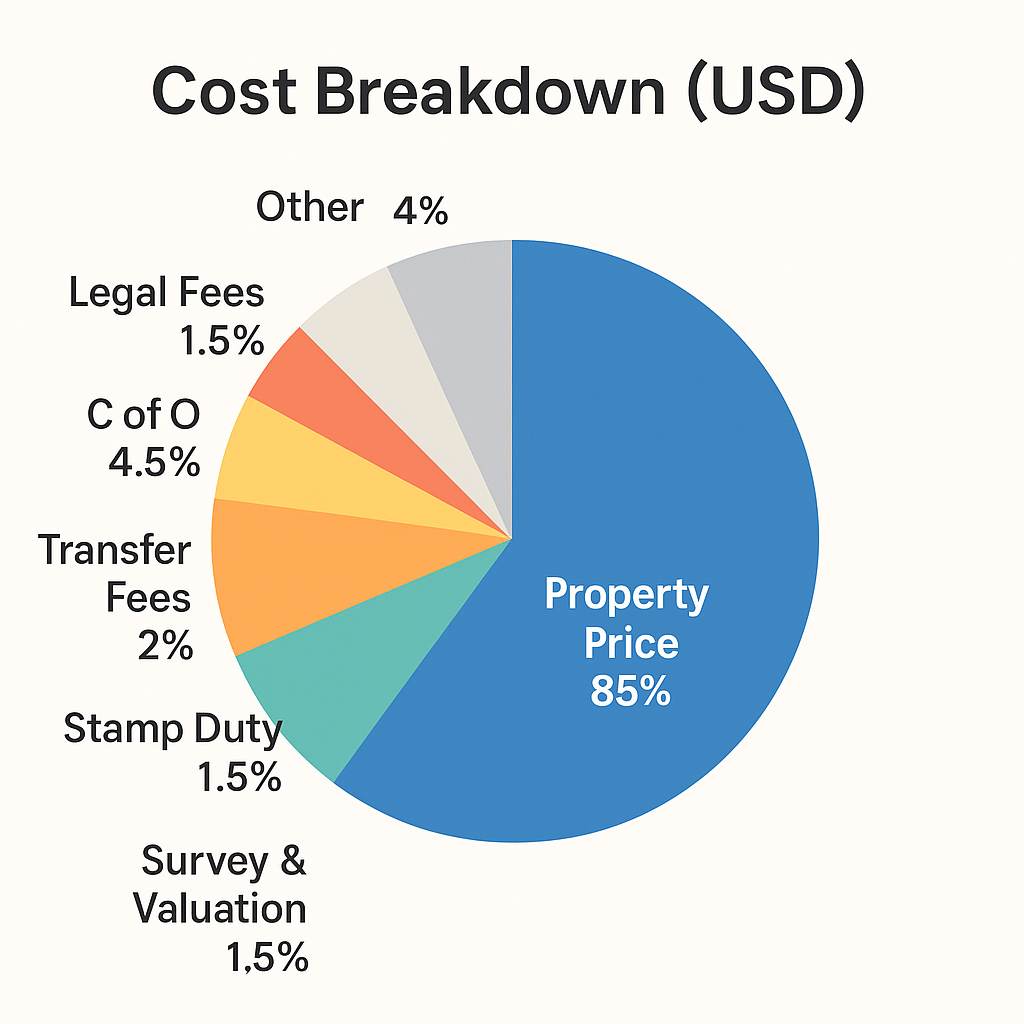

Complete Cost Breakdown: What You'll Actually Pay

Beyond the purchase price, buyers should budget for an additional 10–20% to cover fees and taxes. Here's the comprehensive breakdown:

Fixed Costs (Applicable to All Properties)

| Expense Type | Cost Range | Percentage | Description |

|---|---|---|---|

| Legal Fees | ₦300,000 – ₦1,000,000 | 0.5% – 1% of value | Lawyer fees, title verification, documentation |

| Certificate of Occupancy (C of O) | ₦800,000 – ₦2,000,000 | Varies by state | If property doesn't have one (one-time cost) |

| Governor's Consent | ₦500,000 – ₦1,500,000 | 1.5% – 3% | Required for all ownership transfers |

| Transfer/Registration Fees | 1% – 2% of value | 1% – 2% | Land registry charges for ownership transfer |

| Stamp Duty | 1.5% – 2% of value | 1.5% – 2% | Federal government tax on property transactions |

| Survey Plan | ₦200,000 – ₦500,000 | Fixed | Licensed surveyor for boundary mapping |

| Valuation Report | ₦150,000 – ₦500,000 | Fixed | Professional property assessment |

| Agent Commission | 3% – 5% of value | 3% – 5% | If using a real estate agent (negotiable) |

| Development Levy | ₦50,000 – ₦200,000 | Varies | Community/estate fees (if applicable) |

Real-World Cost Examples

Example 1: ₦30M Property in Ajah, Lagos

- Property Price: ₦30,000,000

- Legal Fees: ₦400,000

- Governor's Consent: ₦450,000

- Transfer Fees (2%): ₦600,000

- Stamp Duty (1.5%): ₦450,000

- Survey & Valuation: ₦400,000

- Total: ₦32,300,000 (7.7% additional)

Example 2: ₦80M Property in Lekki, Lagos

- Property Price: ₦80,000,000

- Legal Fees: ₦800,000

- Governor's Consent: ₦1,200,000

- Transfer Fees (2%): ₦1,600,000

- Stamp Duty (1.5%): ₦1,200,000

- Survey & Valuation: ₦600,000

- Agent Commission (3%): ₦2,400,000

- Total: ₦87,800,000 (9.75% additional)

Example 3: ₦200M Property in Ikoyi, Lagos

- Property Price: ₦200,000,000

- Legal Fees: ₦1,500,000

- Governor's Consent: ₦3,000,000

- Transfer Fees (2%): ₦4,000,000

- Stamp Duty (1.5%): ₦3,000,000

- Survey & Valuation: ₦800,000

- Agent Commission (3%): ₦6,000,000

- Total: ₦218,300,000 (9.15% additional)

Key Takeaway: Budget an additional 8-12% of the property price for all transaction costs. Higher-value properties benefit from percentage economies of scale.

Mortgage and Financing Options in Nigeria

Current Mortgage Market (2025)

Nigerian mortgages remain expensive compared to international markets, but several options exist:

| Bank | Interest Rate | Max LTV | Tenure | Special Features |

|---|---|---|---|---|

| FMBN (Federal Mortgage Bank) | 6% – 9% | 80% | 30 years | Subsidized, limited availability |

| Commercial Banks (Local) | 18% – 25% | 70% – 80% | 15-20 years | Faster approval, strict requirements |

| Diaspora Programs | 15% – 20% | 70% | 15-20 years | For Nigerians abroad, USD collateral accepted |

Mortgage Calculation Examples

Example 1: ₦30M Property (Affordable Entry)

- Down Payment (30%): ₦9,000,000

- Loan Amount: ₦21,000,000

- Interest Rate: 20% annually

- Tenure: 15 years

- Monthly Payment: ≈ ₦450,000

- Total Repayment: ≈ ₦81M

Example 2: ₦60M Property (Mid-Range)

- Down Payment (30%): ₦18,000,000

- Loan Amount: ₦42,000,000

- Interest Rate: 20% annually

- Tenure: 20 years

- Monthly Payment: ≈ ₦850,000

- Total Repayment: ≈ ₦204M

Example 3: ₦100M Property (Premium)

- Down Payment (30%): ₦30,000,000

- Loan Amount: ₦70,000,000

- Interest Rate: 18% annually

- Tenure: 20 years

- Monthly Payment: ≈ ₦1,300,000

- Total Repayment: ≈ ₦312M

Alternative Financing Options

-

Developer Payment Plans

- Many developers offer 6-24 month payment plans

- Typically 30-40% down payment, balance in installments

- Interest-free or lower rates (10-15%)

- Best for off-plan purchases

-

Cooperative Societies

- Lower interest rates (10-15%)

- Requires membership and savings history

- Longer approval process

-

Private Lenders

- Faster approval but higher rates (25-35%)

- Shorter tenure (5-10 years)

- Use with caution, verify legitimacy

-

Family/Personal Savings

- Most common method in Nigeria

- No interest costs

- Full ownership immediately

Qualifying for a Nigerian Mortgage

Minimum Requirements:

- Stable employment for 2+ years (3+ for self-employed)

- Monthly income at least 3x the monthly payment

- Clear credit history

- Nigerian citizenship or permanent residency

- Property must have clear title (C of O, Governor's Consent)

- Comprehensive property insurance

Documents Needed:

- Valid ID (International Passport, NIN, Driver's License)

- Proof of income (6 months bank statements, salary slips)

- Tax clearance certificate (3 years)

- Employment letter/Business registration

- Property documents

- Completed mortgage application form

Reality Check: Only about 5% of property purchases in Nigeria use mortgages. Most buyers pay cash or use developer payment plans due to high interest rates.

Hidden Costs Most Buyers Forget

Beyond the obvious fees, budget for these often-overlooked expenses:

Immediate/One-Time Costs

- Property Inspection: ₦100,000 – ₦300,000 (structural engineer assessment)

- Environmental Assessment: ₦150,000 – ₦500,000 (flood risk, soil stability)

- Title Insurance: ₦200,000 – ₦800,000 (protects against title disputes)

- Moving Costs: ₦100,000 – ₦500,000 (depending on distance and volume)

- Utility Connections: ₦200,000 – ₦1M (electricity, water, gas installation)

- Security Deposits: ₦50,000 – ₦200,000 (estate/landlord association)

Ongoing Annual Costs

- Tenement Rate (Property Tax): 0.5% – 1% of property value annually

- Service Charge (Estates): ₦300,000 – ₦2M/year (security, cleaning, maintenance)

- Land Use Charge: ₦5,000 – ₦500,000/year (varies significantly by location)

- Property Insurance: ₦50,000 – ₦300,000/year

- Estate Development Levy: ₦50,000 – ₦500,000/year (if applicable)

Renovation/Modification Costs (If Needed)

- Minor Renovation: ₦2M – ₦5M (painting, fixtures, fittings)

- Major Renovation: ₦5M – ₦20M (structural changes, complete overhaul)

- Furnishing: ₦3M – ₦15M (depending on quality and completeness)

Essential Due Diligence Checklist

Before signing any agreement:

Document Verification

- Confirm Certificate of Occupancy (C of O) authenticity at State Land Registry

- Verify Governor's Consent is current (must be renewed on transfers)

- Check Survey Plan matches physical property boundaries

- Conduct title search for encumbrances, liens, or disputes

- Verify seller's identity and ownership rights

- Review Deed of Assignment for any restrictive covenants

Physical Inspection

- Visit property multiple times (different times of day)

- Check structural integrity (cracks, foundation, roof)

- Assess drainage and flood risk

- Verify access roads and transportation

- Evaluate neighborhood security

- Check proximity to noise sources (airports, markets, industries)

Legal & Environmental

- Confirm property is not government acquisition zone

- Verify zoning compliance (residential vs. commercial)

- Check for any pending legal disputes

- Assess environmental risks (erosion, flooding)

- Verify utility availability (power, water, gas)

- Confirm no illegal structures or squatters

Financial Preparation

- Secure full payment (or mortgage pre-approval)

- Budget for additional 12-16% transaction costs

- Factor in renovation/modification costs

- Prepare for 6-12 month closing timeline

- Consider currency fluctuation (if foreign buyer)

Smart Buying Strategies for Different Budgets

Budget: ₦10M – ₦25M (First-Time Buyers)

Target Cities: Ibadan, Ilorin, suburbs of major cities Property Type: 2-3 bedroom apartments, small bungalows Strategy:

- Focus on emerging areas with development potential

- Consider developer payment plans

- Target properties near universities for rental potential

- Prioritize clear documentation over premium location

Budget: ₦25M – ₦60M (Mid-Range Buyers)

Target Cities: Abuja suburbs, Lagos emerging areas, Port Harcourt, Enugu Property Type: 3-4 bedroom apartments, semi-detached houses Strategy:

- Balance between location and affordability

- Look for properties in gated estates for security

- Consider rental yield potential (6-10%)

- Negotiate developer discounts for cash payment

Budget: ₦60M – ₦150M (Upper Mid-Range)

Target Cities: Lagos (Ajah, Sangotedo), Abuja (Lugbe, Karsana) Property Type: 4-bedroom duplexes, detached houses Strategy:

- Focus on established neighborhoods

- Prioritize security and infrastructure

- Target expatriate/corporate rental market

- Consider short-let potential for higher returns

Budget: ₦150M+ (Premium Buyers)

Target Cities: Lagos (Lekki, Ikoyi), Abuja (Maitama, Asokoro) Property Type: Luxury homes, penthouses, waterfront properties Strategy:

- Invest in ultra-premium locations

- Focus on lifestyle amenities and views

- Target international tenants (embassies, multinationals)

- Consider as legacy/generational wealth

Final Thoughts

Understanding the true cost of buying property in Nigeria — including all fees, taxes, and hidden expenses — is crucial for making informed decisions and avoiding financial surprises.

Key Takeaways:

- Budget Realistically: Add 12-16% to property price for transaction costs

- Verify Everything: Never skip due diligence, no matter how urgent

- Work with Professionals: Hire licensed agents and experienced property lawyers

- Plan Long-Term: Nigerian real estate is best for 5+ year horizons

- Prioritize Documentation: Clear titles matter more than property appearance

The Nigerian real estate market offers opportunities at every price point, from ₦8M starter apartments in Ibadan to ₦500M luxury homes in Ikoyi. Success lies in matching your budget to realistic expectations, conducting thorough due diligence, and working with trusted professionals.

Remember: In Nigerian real estate, patience and proper documentation protect your investment more than rushing to close deals. Take your time, verify thoroughly, and build wealth securely.

Empowering smart property investment decisions in Nigeria.